Investing has always been closely associated with math, and it takes a little math to figure out how long it takes for an investment to double. Many people expect any investment will just double in a certain number of years, and for very broad averages you can follow certain rules of thumb. The average return of the S&P 500 is about 10%, which means you can double your money by investing in the stock market roughly every seven years as long as your investments and market conditions are “average.”

But what if you’re not investing in the stock market? What if your investment has a different rate of return? What is an easy way to find out how long it takes to double your money under different circumstances?

There’s Always a Trick, and It Always Involves Math

I’m one of those guys that has a multiplication chart printed out and tacked to the wall. You might call it a wasted year of fourth grade math, but for me a pocket calculator was good enough for figuring out common multiplication problems. That means I’m even more impressed by people who can seemingly work magic like instantly telling you how fast your money multiples by two for a given interest rate. Like every other good bit of magic, there’s a simple trick that even the most mathematically disinclined can use to instantly estimate the doubling time for an investment at a specific rate of return. It’s called the Rule of 72 and it’s what the Warren Buffets of the world do instinctively to evaluate investment returns in real time.

What is the Rule of 72?

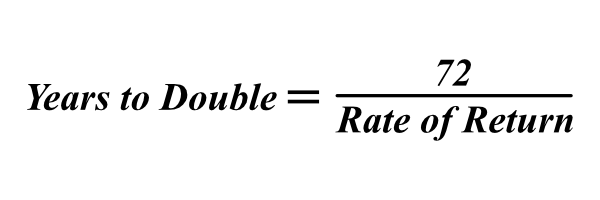

The Rule of 72 provides a quick shortcut for finding the doubling time of an investment using some simple arithmetic. The basic formula looks like this…

As an example, if you make an investment that returns 12% annually, it will take roughly six years to double the value of that investment. You can calculate this fact instantly by dividing 72 by 12… For people who have their times 12 multiplication tables memorized, this is easy or it’s a quick glance at a multiplication chart if you’re like me.

72 is a useful number for this rule of thumb because it has so many factors. Potential values for interest rates including numbers like 2, 3, 4, 6, 8, 9, 12, 18 and 24 are some of the factors of 72. These whole number factors make solving the Rule of 72 fairly easy to do in your head with a little practice.

You can find the doubling time for rates that don’t evenly divide 72 quickly with a calculator, but another trick is to estimate if the rate falls between two of the easier to solve factors. Consider an example investment that has an annual return of 7%. If the interest rate was 6%, the rule tells us the doubling time would be 12 years, and similarly if the interest rate was 8% the doubling time would be 9 years. Our doubling time for 7% is going to be between these 9 year and 12 year estimates. The difference between 9 and 12 is three, and splitting the difference would be 1.5 years. Tack that onto 9 year estimate for 8% and we get 10.5 years to double at 7%… That’s pretty close to the 10.3 year value a calculator division yields.

Sometimes It’s Good to be Bad at Math… Enter the Rule of 69

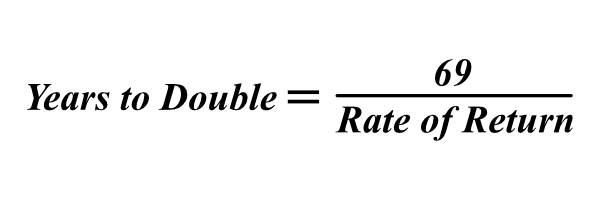

All those convenient factors that divide 72 make finding the doubling time easier to do mentally, but they come at the cost of precision. It turns out, the actual doubling math works slightly more accurately if the numerator in our rule of thumb is 69 instead of 72…

If you’re breaking out the calculator to solve these problems anyway, you might as well use a more precise formula. As an example, for an investment with a 12% rate, you’ll recall the Rule of 72 quickly told us it would take 6 years to double. However, the Rule of 69 (and my calculator) tells us that investment will double in just 5.75 years. An investment with a 3% rate of return gives 24 years and 23 years with the two different rules – an entire year of time difference. That extra bit of accuracy may be the edge you need when comparing two investments!ß

Any investment decision can involve other factors such as inflation, taxes or risk. However, a quick estimate of how long it takes to double your original investment can be a great way to provide context or to compare two alternatives. Start using the Rule of 72 or the Rule of 69 in your routine thinking and you’ll be well on your way to better evaluating the investment opportunities that come your way!